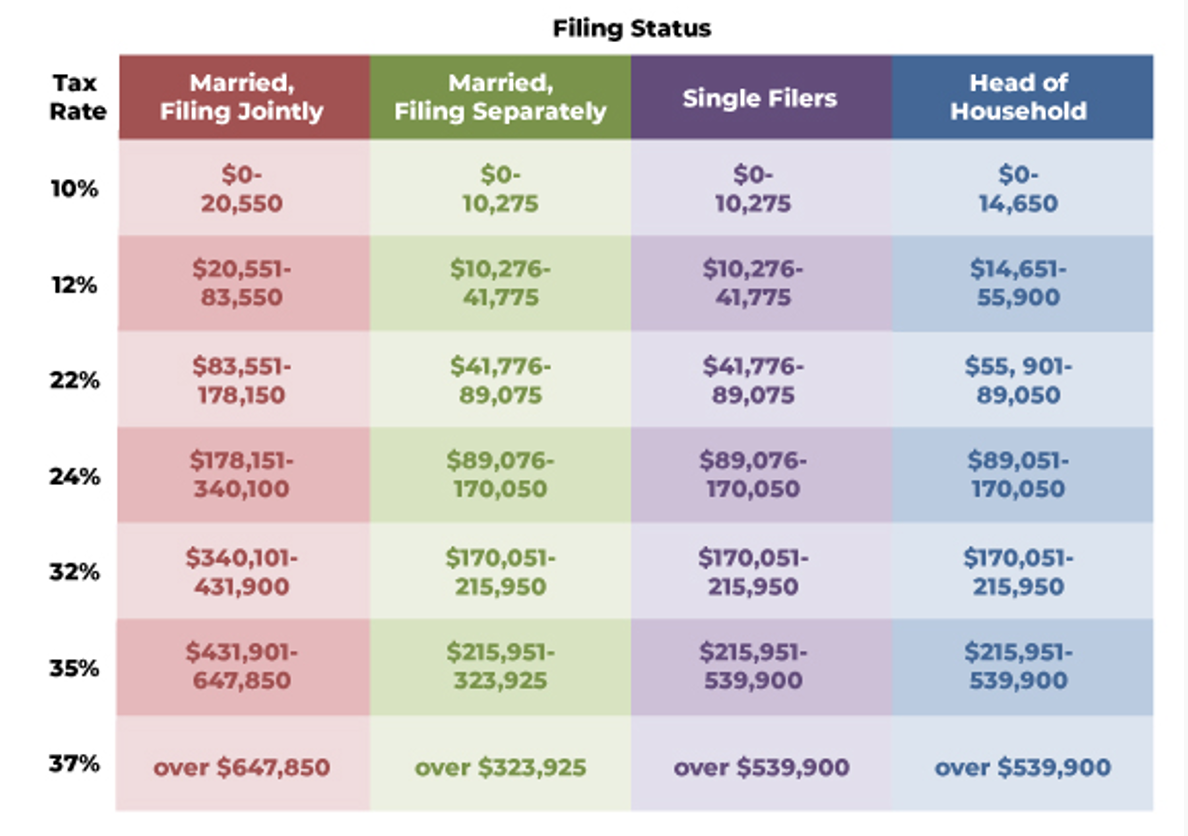

Single Income Household Tax . But some of your income will be taxed. Here’s how that works for a single person earning $58,000 per year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web there are seven federal income tax rates in 2022: Web for a single taxpayer, the rates are: Taxable income and filing status. Web in 2024, there are seven federal income tax rates and brackets: Your marginal—or top—tax rate is 22%. Web the federal income tax has seven tax rates in 2024: Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web let’s say you’re single and your 2024 taxable income is $75,000; 2023 tax rates for other. Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules.

from daniakelcie.pages.dev

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Taxable income and filing status. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. But some of your income will be taxed. Find your total tax as a percentage. Here’s how that works for a single person earning $58,000 per year: Web for a single taxpayer, the rates are: Web let’s say you’re single and your 2024 taxable income is $75,000; 2023 tax rates for other. Your marginal—or top—tax rate is 22%.

Tax Brackets Head Of Household 2025 Jackie Emmalyn

Single Income Household Tax 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Taxable income and filing status. Web for a single taxpayer, the rates are: Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. But some of your income will be taxed. Find your total tax as a percentage. Web the federal income tax has seven tax rates in 2024: Web in 2024, there are seven federal income tax rates and brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Here’s how that works for a single person earning $58,000 per year: 2023 tax rates for other. Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Your marginal—or top—tax rate is 22%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web there are seven federal income tax rates in 2022:

From daniakelcie.pages.dev

Tax Brackets Head Of Household 2025 Jackie Emmalyn Single Income Household Tax Web let’s say you’re single and your 2024 taxable income is $75,000; Your marginal—or top—tax rate is 22%. Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. Single Income Household Tax.

From hkglcpa.com

Tax Rates Heemer Klein & Company, PLLC Single Income Household Tax 2023 tax rates for other. Find your total tax as a percentage. Here’s how that works for a single person earning $58,000 per year: Taxable income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web for a single taxpayer, the rates are: But some of your income will be taxed.. Single Income Household Tax.

From imagetou.com

Tax Thresholds 2024 25 Image to u Single Income Household Tax Find your total tax as a percentage. Here’s how that works for a single person earning $58,000 per year: Web the federal income tax has seven tax rates in 2024: Taxable income and filing status. But some of your income will be taxed. Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax. Single Income Household Tax.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress Single Income Household Tax Web there are seven federal income tax rates in 2022: Web the federal income tax has seven tax rates in 2024: Web let’s say you’re single and your 2024 taxable income is $75,000; Here’s how that works for a single person earning $58,000 per year: 2023 tax rates for other. Taxable income and filing status. Web in 2020, the income. Single Income Household Tax.

From sonniqjoeann.pages.dev

Tax Brackets 2024 Married Jointly Tax Rates Jyoti Lindsey Single Income Household Tax Web in 2024, there are seven federal income tax rates and brackets: Your marginal—or top—tax rate is 22%. Web let’s say you’re single and your 2024 taxable income is $75,000; Find your total tax as a percentage. 2023 tax rates for other. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web estimate federal. Single Income Household Tax.

From absoluteaccountingsrv.com

Tax Rates Absolute Accounting Services Single Income Household Tax 2023 tax rates for other. Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web for a single taxpayer, the rates are: But some of your income will be taxed. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37. Single Income Household Tax.

From www.pinterest.com

IRS Releases Key 2021 Tax Information standarddeduction2021 Single Income Household Tax Web let’s say you’re single and your 2024 taxable income is $75,000; Here’s how that works for a single person earning $58,000 per year: Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. Web for a single taxpayer, the rates are: Taxable income and filing status. 2023 tax rates for. Single Income Household Tax.

From www.comparehero.my

T20, M40 And B40 Classifications In Malaysia Single Income Household Tax Web for a single taxpayer, the rates are: 2023 tax rates for other. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Here’s how that works for a single person earning $58,000 per year: Web let’s say you’re single and your 2024 taxable income is $75,000; Web estimate federal income tax for 2020, 2019,. Single Income Household Tax.

From lifeonaire.com

The Benefits of a Single Household Lifeonaire Single Income Household Tax But some of your income will be taxed. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 2023 tax rates for other. Web the federal income tax has seven tax rates in 2024: Web in 2024,. Single Income Household Tax.

From www.purposefulfinance.org

IRS 2021 Tax Tables, Deductions, & Exemptions — purposeful.finance Single Income Household Tax 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web the federal income tax has seven tax rates in 2024: Your marginal—or top—tax rate is 22%. Web there are seven federal income tax rates in 2022: Web for a single taxpayer, the rates are: Web let’s say you’re single and your 2024 taxable income is $75,000; 10 percent, 12 percent, 22. Single Income Household Tax.

From projectopenletter.com

2022 Tax Brackets Single Head Of Household Printable Form, Templates Single Income Household Tax Web in 2024, there are seven federal income tax rates and brackets: Taxable income and filing status. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. But some of your income will be taxed. Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. 10 percent, 12 percent, 22 percent, 24 percent,. Single Income Household Tax.

From nixieqjessika.pages.dev

2024 Tax Brackets And Standard Deduction Table Cate Marysa Single Income Household Tax Web the federal income tax has seven tax rates in 2024: Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Here’s how that works for a single person earning $58,000 per year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web estimate federal income. Single Income Household Tax.

From properly.com.my

B40, M40, and T20 Classification Properly Single Income Household Tax 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Taxable income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. Here’s how that works for a. Single Income Household Tax.

From www.moneylion.com

Head of Household vs Single How Should You File Your Taxes Single Income Household Tax Web the federal income tax has seven tax rates in 2024: Web let’s say you’re single and your 2024 taxable income is $75,000; Web there are seven federal income tax rates in 2022: Web for a single taxpayer, the rates are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35. Single Income Household Tax.

From www.youtube.com

What filing Status am I on my Tax Return ? / Tax Tips 8 Single Income Household Tax Web let’s say you’re single and your 2024 taxable income is $75,000; 2023 tax rates for other. Web estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. Here’s how that works for a single person earning $58,000 per year: Web the federal income tax has seven tax rates in 2024: 10. Single Income Household Tax.

From www.businessinsider.com

New 2018 tax brackets for single, married, head of household filers Single Income Household Tax Find your total tax as a percentage. Web in 2024, there are seven federal income tax rates and brackets: Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Here’s how that works for a single person earning $58,000 per year: 10 percent, 12 percent,. Single Income Household Tax.

From merciycaterina.pages.dev

Tax Standard Deduction 2024 Bab Aigneis Single Income Household Tax Web let’s say you’re single and your 2024 taxable income is $75,000; Web in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Taxable income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Find your total. Single Income Household Tax.

From boxden.com

Oct 19 IRS Here are the new tax brackets for 2023 Single Income Household Tax Web let’s say you’re single and your 2024 taxable income is $75,000; Web in 2024, there are seven federal income tax rates and brackets: Your marginal—or top—tax rate is 22%. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web for a single taxpayer, the rates are: Web there are seven federal income tax rates in 2022: Find your total tax. Single Income Household Tax.